29 Jun Knowing Your Customer Acquisition Cost (CAC)

Customer Acquisition Cost is one of the most important metrics a startup can use. Here is a detailed guide to help you leverage it.

Customer Acquisition Cost (CAC)

“is the cost associated in convincing a customer to buy a product/service.”

Using CAC as a health and growth metric has its advantages for both the company and investors. It can show a myriad of items including such as:

- How effective funds are being spent on marketing

- The value of each customer

- A & B testing results of cost expenditure in relation to marketing

- Profitability of the company overtime

- Corrective actions towards profitability

For example, imagine you are selling lemonade at a lemonade stand. Upon first glance, the business is booming. On average you are selling nearly 1,000 cups of lemonade a day for $2.00 each. The cost to make the lemonade is $1.00 per cup: in theory giving the lemonade stand a net profit of $1.00 per cup or $1,000 a day on average. Yet the stand is losing money. Why is this? Upon viewing the business in depthly, you quickly realize that the lemonade stand is spending nearly $1,500 a day on advertising. This equates to Customer Acquisition Cost of $1.50 per cup sold. When this is combined with the cost of making the cup of lemonade, the total cost per cup rises to $2.50. This means there is a net loss for the stand of $0.50 per cup, or $500 a day.

Using the CAC metric in the above example, it clearly shows how the company is spending their capital on marketing. On top of this, it gives the company and investors insight into possible solutions to their unprofitability.

Firstly, the company needs to determine how effective their marketing efforts are in comparison to the amount of customers they have. In essence, is their marketing driving sales? If the answer is an unequivocal “Yes”. Then the lemonade stand will have to raise the sale price of their product or reduce cost. If the answer is “No”, or even “Partially”. Then the capital spent on marketing needs to be cut back. By lowering the marketing cost, the CAC will also decrease; thus increasing the profitability of each cup sold and the overall profitability of the company.

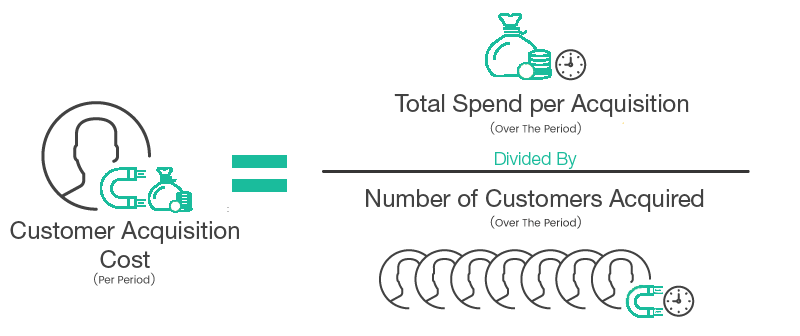

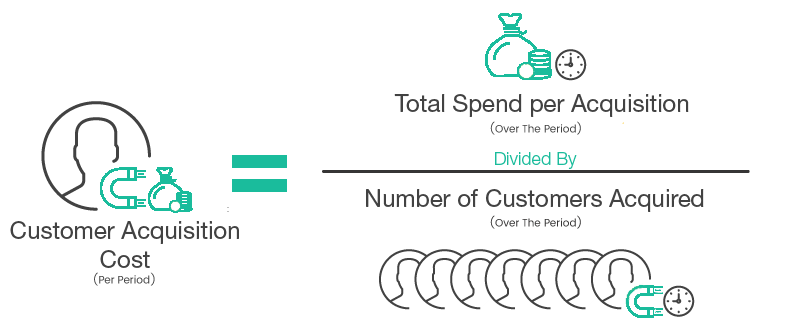

Calculating the Customer Acquisition Cost for your company is straightforward and quite simple. You will need three items:

- A Time Period (Monthly, Quarterly, Yearly)

- Total Spend per Acquisition

- Total Number of Customers Acquired

When those items are defined follow the calculation below:

As one can see, the Customer Acquisition Cost metric is robust enough to show how effective the marketing expenditures of a company are─ as well as shining light on areas which could use improvement.

It’s simple to calculate and has far reaching value. Keep it in mind as your startup grows. If you would like to learn more about Customer Acquisition Cost and how it effects your business, feel free to contact us today.